After screeching to a halt in March and April, the global economy has begun to show signs of forward progress. In day to day life, people are adapting to the pandemic. Health experts are advancing credible plans for emerging from lockdown, and testing and contact tracing may bolster health care capacity as we try to return to work.

Despite this tentative reprieve from doom and gloom, economic data remains at odds with bullish price action in risk assets. Can the good times last?

Rather than predict the outcome, we believe investors should learn to live with our new COVID-19 reality. Fortunately, with a few little tweaks, investors can apply medical experts’ day-to-day recommendations to their portfolios. Just as in life, there is no 100% insurance against COVID-19, but reasonable steps can help investors manage through these difficult times.

Lockdown: Minimize Unnecessary Stock Market Interactions

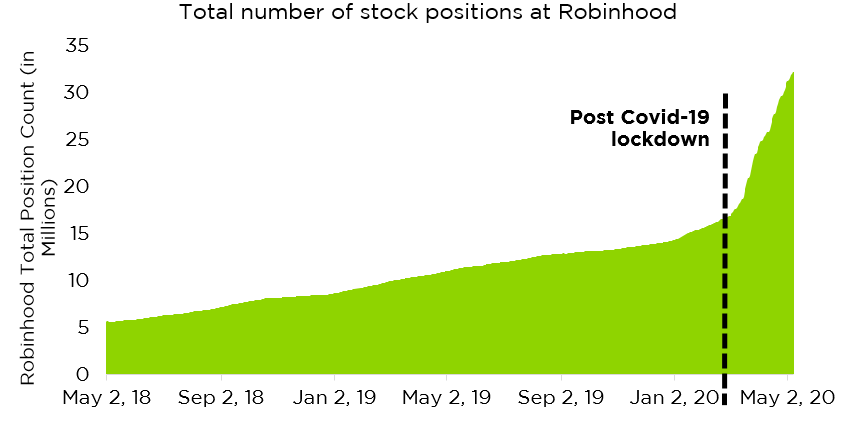

As cabin fever sets in, we believe investors should consider avoiding all but the most essential trips to brokerage websites. Unfortunately, it appears few are following this guideline. Retail interest in stocks resembles that of past bubble peaks: The number of positions on Robinhood has skyrocketed amid lockdowns, suggesting a flood of inexperienced daytraders into the markets.

Robinhood stock positions spike during coronavirus crisis

We counsel against this type of frivolous excursion. If you have to stay glued to a screen, consider Robin Hood: Men in Tights instead of Robinhood for iOS.

Testing and Contact Tracing

Just as hand-washing may reduce contagion risk, routine activities can help investors take a prudent approach to risk. Investors and advisors should revisit risk budgets and align portfolios with drawdown tolerance. Those who were unable to stomach the first-quarter stock market drop should reevaluate their stock allocation, and consider how diversifiers and trend following strategies might ease the risk-reward tradeoff.

Risk Mitigation Equipment

Masks help prevent COVID spread. Similarly, specific tools can help manage risk in investor portfolios. Alternative strategies and cash have historically offered relative safety during tumultuous markets.

Investors have lately been scratching their heads at an apparent disconnect between economic damage from the pandemic and apparent stock market optimism. In such environments investors might consider systematic investment processes that seek to minimize emotional, short-term decisions. Better-defined processes can keep managers from making bad situations worse.

Many investment strategies with less relationships to market movements, such as long-short alternative equity strategies and trend following strategies, experienced reduced volatility as markets fell in early 2020. Such strategies may help insulate portfolios from further market shocks, and deserve consideration during the pandemic.

Conclusion

With no clear path for a quick return to “normal,” we feel investors need to adjust their day-to-day lives for the reality of a persistent COVID-19 pandemic. Fortunately, expert guidelines that combat the real-world disease can be adapted to investor decisions. Avoiding needless contact with the stock market, properly testing and cleaning up portfolio risk allocations, and using risk mitigation equipment like alternative investment strategies could be reasonable ways to accommodate this new reality. To navigate this tumultuous period, investors should accept the limits of what they can know and make the most of the precautionary resources at their disposal.